Mileage Allowance Free Printable Mileage Log 2013-2025 free printable template

Show details

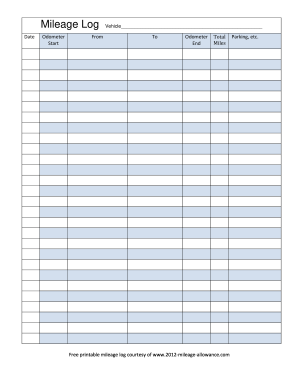

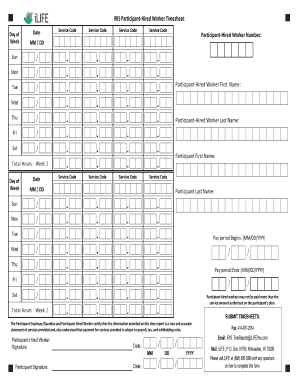

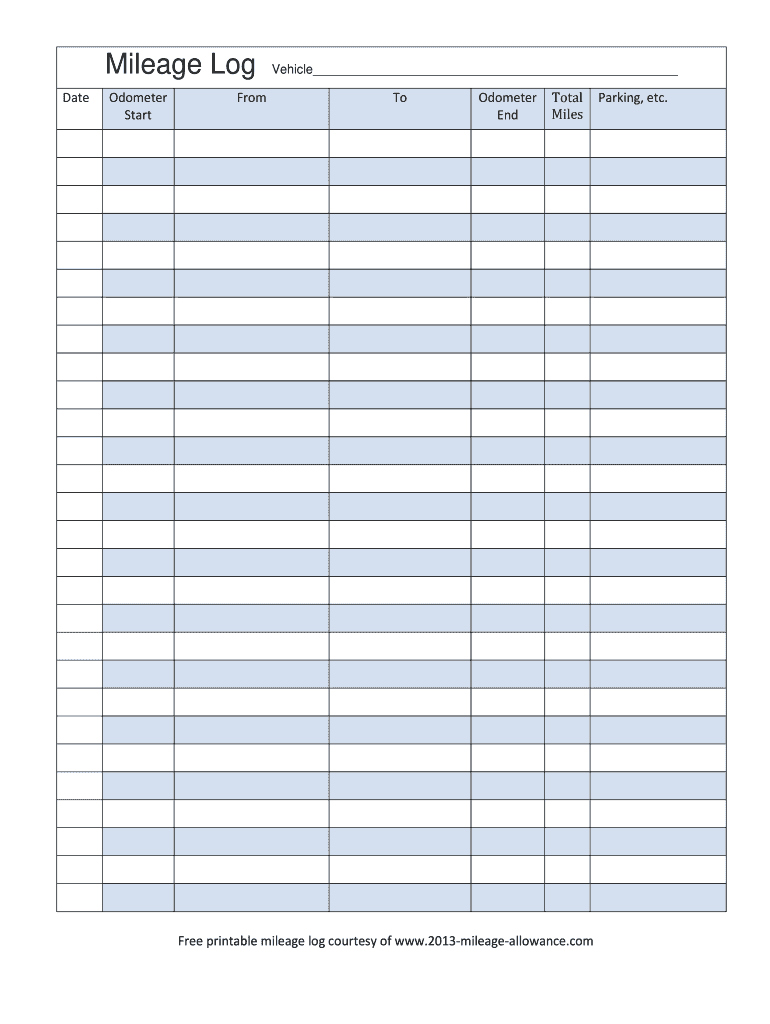

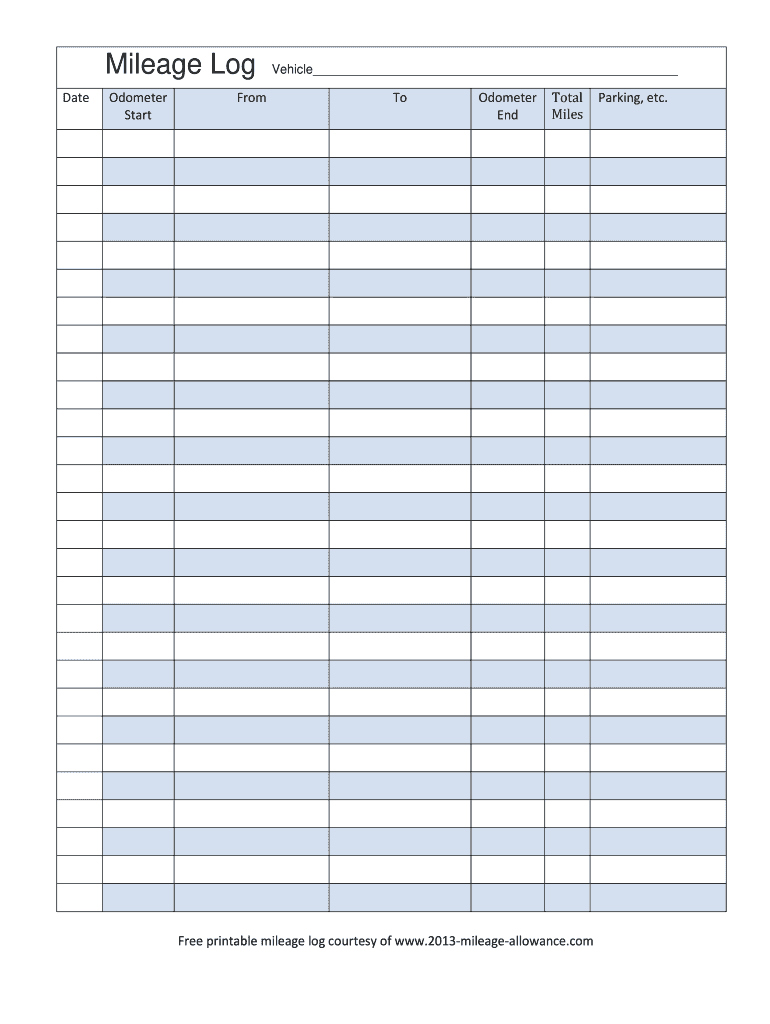

Mileage Log Date Odometer Start From Total Miles Vehicle To End Free printable mileage log courtesy of www.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mileage log printable form

Edit your printable log blank form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mileage printable fill out form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing vehicle mileage log online

Follow the steps below to benefit from a competent PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mileage printable printable form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Mileage Allowance Free Printable Mileage Log Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out mileage allowance printable log form

How to fill out Mileage Allowance Free Printable Mileage Log

01

Start with the date of the trip.

02

Record the starting point and destination.

03

Note the purpose of the trip.

04

Measure the total mileage traveled.

05

Include any additional expenses related to the trip, if applicable.

06

Sign and date the log for verification.

Who needs Mileage Allowance Free Printable Mileage Log?

01

Individuals who use their personal vehicle for business purposes.

02

Self-employed professionals who need to track mileage for tax deductions.

03

Employees who need to report mileage to their employer for reimbursement.

04

Anyone participating in a volunteer activity that involves travel.

Fill

mileage allowance log

: Try Risk Free

People Also Ask about mileage printable print

What does the IRS require for mileage log?

In short, you have to keep a mileage log that demonstrates the following: The distance traveled: the number of miles driven for each work trip. The date and time of each trip. The location: each business trip's final destination.

How do I automatically calculate mileage in Excel?

Use Excel's Insert Function option to easily call PC*MILER functions and insert your arguments. The Miles function returns the driving distance from the origin to the destination.

What does IRS require for mileage log?

In short, you have to keep a mileage log that demonstrates the following: The distance traveled: the number of miles driven for each work trip. The date and time of each trip. The location: each business trip's final destination.

How do you make a mileage log?

ing to the IRS, you must include the following in your mileage log template: The mileage driven for each business-related trip. The date of each trip. The destination and purpose of your trip. The total mileage you've driven for the year.

What does the IRS require for a mileage log?

In short, you have to keep a mileage log that demonstrates the following: The distance traveled: the number of miles driven for each work trip. The date and time of each trip. The location: each business trip's final destination.

How do you keep track of mileage?

Tips for keeping track of mileage Use your odometer. Depending on the age of your vehicle, you either have a mechanical or digital odometer. Download a mile tracker app. Another option is to download a mile tracker app. Google Maps, Apple Maps, or Waze.

Does IRS ask for proof of mileage?

Both the standard mileage rate and the actual expenses method require accompanying IRS-proof mileage logs in order to be eligible for a car mileage tax deduction. The IRS will want detailed mileage logs if your claim is audited.

How do I create a mileage log?

ing to the IRS, you must include the following in your mileage log template: The mileage driven for each business-related trip. The date of each trip. The destination and purpose of your trip. The total mileage you've driven for the year.

How do I keep track of my work mileage?

Top mileage and expense tracking apps in 2023 Fyle. Fyle's mileage tracker is powered by Google Maps. Stride. Stride is a free app that automatically logs every mile you drive and generates a tax compliant report to ease your tax-filing process. TripLog. Hurdlr. MileIQ. SherpaShare.

What needs to be included in a mileage log?

Therefore, each entry in a mileage log should include the date, the destination, the business purpose, the odometer reading at the start and end of travel and the total mileage for each trip.

Does IRS want proof of mileage?

Both the standard mileage rate and the actual expenses method require accompanying IRS-proof mileage logs in order to be eligible for a car mileage tax deduction. The IRS will want detailed mileage logs if your claim is audited.

How do I create a mileage spreadsheet?

How To Create a Company Mileage Log For Taxes For a business purpose, record the beginning and end readings on the odometer for a trip. Subtract the odometer reading from the beginning to the end of a trip to get the business miles driven. Enter the business miles on the correct day in a calendar.

How do I fill out a mileage reimbursement?

Example: You have driven 1200 business miles in 2022 with your personal vehicle. The IRS mileage rate in 2022 was 62.5 cents per mile (from July 1, 2022) for owning and operating your vehicle for business purposes. [miles] * [rate], or 1200 miles * $0.625 = $750 you can claim as deduction on your tax return.

How do you fill out a mileage sheet?

ing to the IRS, you must include the following in your mileage log template: The mileage driven for each business-related trip. The date of each trip. The destination and purpose of your trip. The total mileage you've driven for the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my mileage printable log directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign printable log online and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit printable mileage form online?

The editing procedure is simple with pdfFiller. Open your printable mileage log in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I sign the gas and mileage log sheets electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your mileage reimbursement form and you'll be done in minutes.

What is Mileage Allowance Free Printable Mileage Log?

A Mileage Allowance Free Printable Mileage Log is a document that individuals can use to track and record their business-related mileage for tax purposes or reimbursement.

Who is required to file Mileage Allowance Free Printable Mileage Log?

Individuals who use their personal vehicles for business activities, such as employees, independent contractors, or business owners, are required to file a Mileage Allowance Free Printable Mileage Log.

How to fill out Mileage Allowance Free Printable Mileage Log?

To fill out a Mileage Allowance Free Printable Mileage Log, enter the date of travel, starting and ending locations, purpose of the trip, and the total miles driven for each business trip.

What is the purpose of Mileage Allowance Free Printable Mileage Log?

The purpose of a Mileage Allowance Free Printable Mileage Log is to provide a clear record of business mileage that can be used for tax deductions or reimbursement claims.

What information must be reported on Mileage Allowance Free Printable Mileage Log?

The information that must be reported on a Mileage Allowance Free Printable Mileage Log includes the date of the travel, the vehicle odometer readings (start and end), purpose of the trip, and the total distance traveled.

Fill out your Mileage Allowance Printable Mileage Log online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Printable Log Fill Online is not the form you're looking for?Search for another form here.

Keywords relevant to mileage log forms

Related to mileage log pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.