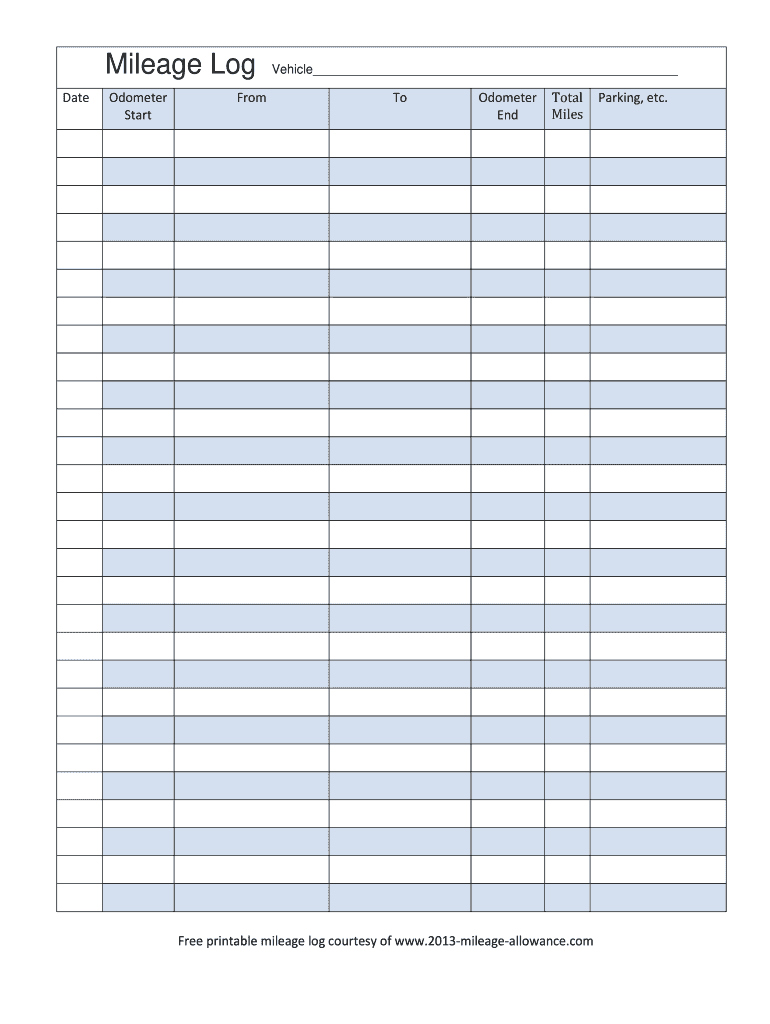

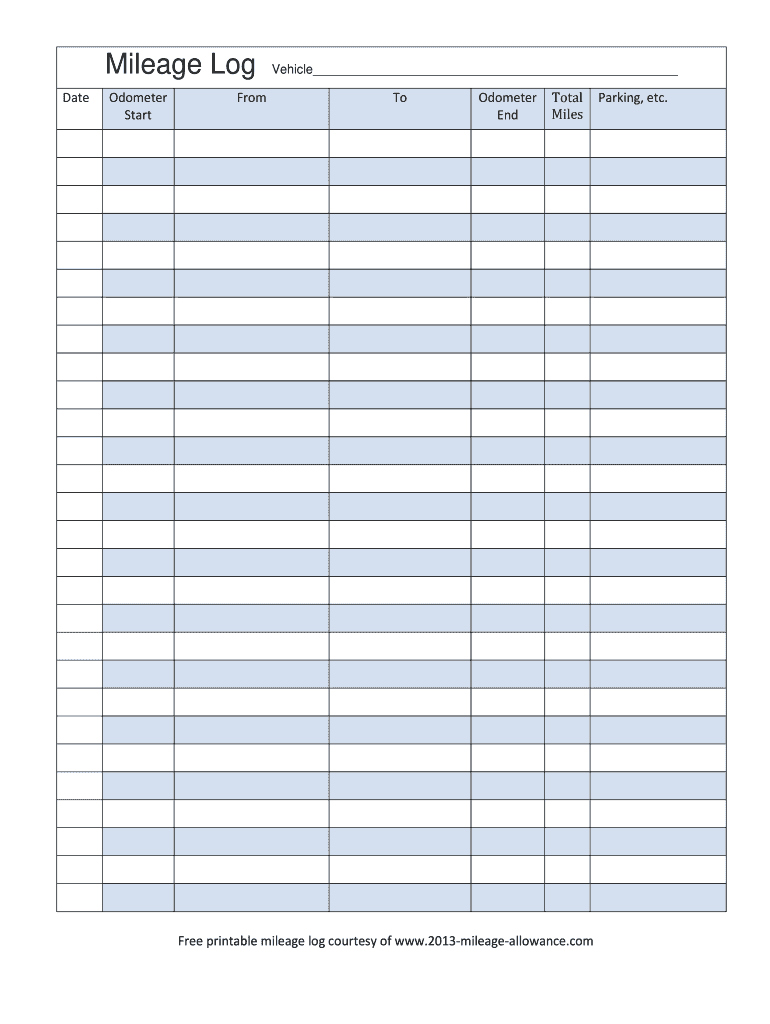

Mileage Allowance Free Printable Mileage Log 2013-2024 free printable template

Get, Create, Make and Sign

Editing mileage log online

Mileage Allowance Free Printable Mileage Log Form Versions

How to fill out mileage log 2013-2024 form

How to fill out a mileage log:

Who needs a mileage log:

Video instructions and help with filling out and completing mileage log

Instructions and Help about printable mileage log pdf form

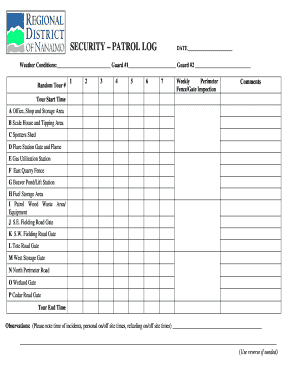

Welcome to your printable mileage log the purpose of this form is to be printed and kept in your car to record my lease it will be deductible on your tax returns on this form you'll put in the vehicle the month and the year and as you travel you'll post the date who where and why the purpose of the trip the start of the odometer the end of the odometer and the total for business medical charity or moving the purpose of this log is to populate the mileage record that's in your what counts program at the end of each month you'll post that information here and then return to your mileage form and print a new one to keep in your car I would suggest you keep this form in a binder or something else that will protect it, so it will be clear and legible for your records at the end of each month after you post this information into your mileage records you will want to take this form and put it in your envelope with your monthly receipts and your monthly profit and loss statement as usual on this forum is your return to the table of contents connection to your tax professional help for this page this video your exit and print instructions also the introductory video and as usual the quick links back to your monthly worksheets you

Fill mileage log printable : Try Risk Free

People Also Ask about mileage log

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your mileage log 2013-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.